Posts Tagged ‘Stafford Loans’

The Young Politica: What’s Next for Student Loans

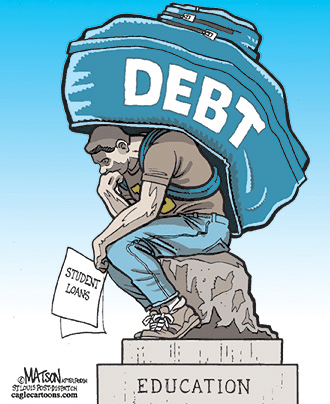

In my last column, I wrote about how the sequester could deeply impact students of all ages—by cutting education jobs, programs like Head Start, food stamps, and limiting financial aid. Well, once again, kids trying to get an education are at risk of being undercut by the federal government.

The interest rate of new federally subsidized Stafford loans will revert to 6.8 percent from 3.4 percent. The rate subsidized loans, which go to low-income households, was supposed to rise to 6.8 percent back in June 2012, but the rate’s expiration was postponed for a year. This year’s extension lasts until June 30, 2013. If Congress does not act to change the rules or extend the loan rate expiration date, an estimated 7.4 million college students will be affected.

Note that each year the date to change the rate is extended, the federal government loses out on about $6 billion in revenue. But students don’t necessarily have to be the ones paying the price. If there would have been more oversight on the financial aid process, the federal government could have prevented a loss of $200 million in federal student aid fraud since 2009.

What’s a good solution? Rather than postponing the expiration again, the House Education and the Workforce Committee argued that Congress should reevaluate their rate-setting process for all government-issued college loans.

FoxNews.com reports that the Department of Education has also been sending out letters to inform Direct PLUS Loan borrowers that their fees are being raised as a direct result of the automatic budget cuts (or the sequester) that happened after the federal government could not come to a fiscal agreement. Fees for loans issued after March 1, 2013, will have an adjusted loan rate fee—from 4.0 percent to 4.204 percent.

Students are taking more and more hits, but at least they’re putting up a fight.

Read More